Word格式/直接打印/内容可修改

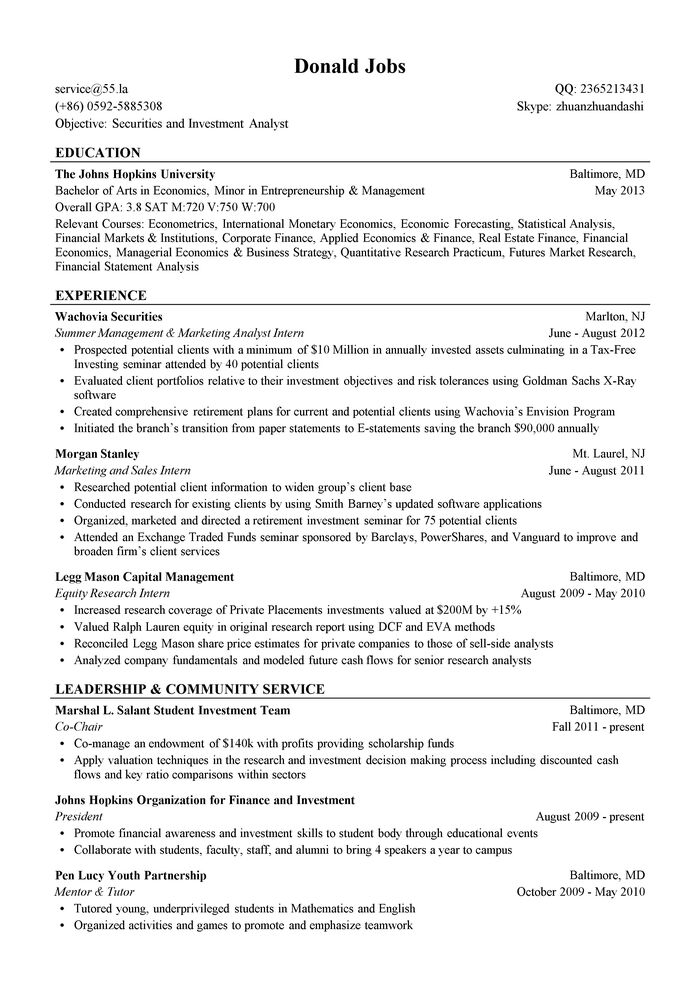

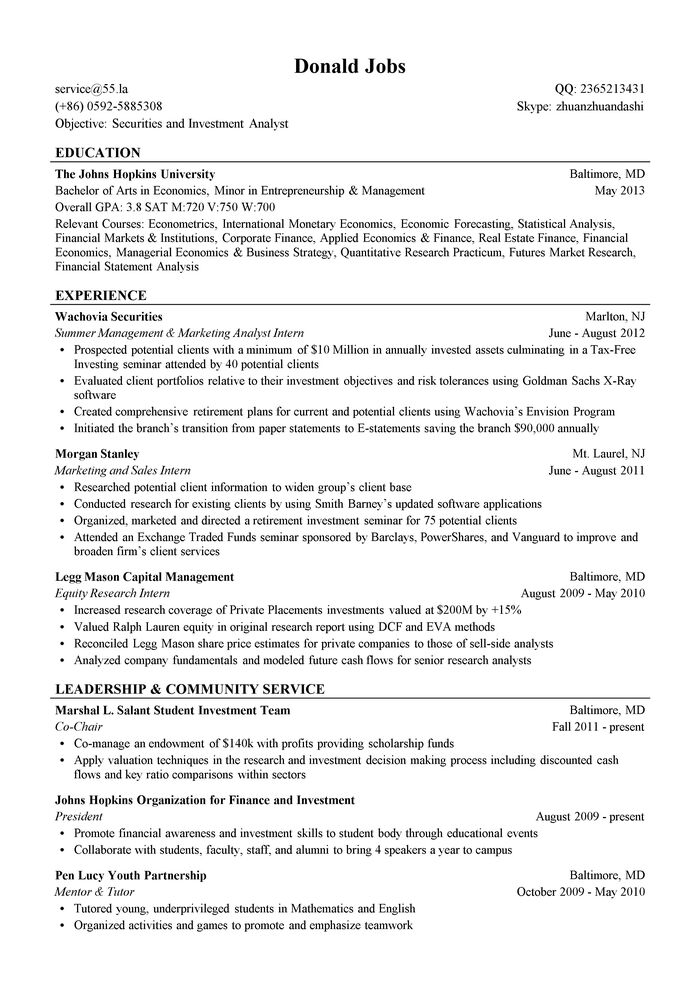

Donald Jobs

|

service@55.la

|

QQ: 2365213431

|

(+86) 0592-5885308

|

Skype: zhuanzhuandashi

|

Objective: Securities and Investment Analyst

|

EDUCATION

|

|

|

The Johns Hopkins University

|

Baltimore, MD

|

Bachelor of Arts in Economics, Minor in Entrepreneurship & Management

|

May 2013

|

Overall GPA: 3.8 SAT M:720 V:750 W:700

|

Relevant Courses: Econometrics, International Monetary Economics, Economic Forecasting, Statistical Analysis, Financial Markets & Institutions, Corporate Finance, Applied Economics & Finance, Real Estate Finance, Financial Economics, Managerial Economics & Business Strategy, Quantitative Research Practicum, Futures Market Research, Financial Statement Analysis

|

EXPERIENCE

|

|

|

Wachovia Securities

|

Marlton, NJ

|

Summer Management & Marketing Analyst Intern

|

June - August 2012

|

•

|

Prospected potential clients with a minimum of $10 Million in annually invested assets culminating in a Tax-Free Investing seminar attended by 40 potential clients

|

•

|

Evaluated client portfolios relative to their investment objectives and risk tolerances using Goldman Sachs X-Ray software

|

•

|

Created comprehensive retirement plans for current and potential clients using Wachovia’s Envision Program

|

•

|

Initiated the branch’s transition from paper statements to E-statements saving the branch $90,000 annually

|

|

|

Morgan Stanley

|

Mt. Laurel, NJ

|

Marketing and Sales Intern

|

June - August 2011

|

•

|

Researched potential client information to widen group’s client base

|

•

|

Conducted research for existing clients by using Smith Barney’s updated software applications

|

•

|

Organized, marketed and directed a retirement investment seminar for 75 potential clients

|

•

|

Attended an Exchange Traded Funds seminar sponsored by Barclays, PowerShares, and Vanguard to improve and broaden firm’s client services

|

|

|

Legg Mason Capital Management

|

Baltimore, MD

|

Equity Research Intern

|

August 2009 - May 2010

|

•

|

Increased research coverage of Private Placements investments valued at $200M by +15%

|

•

|

Valued Ralph Lauren equity in original research report using DCF and EVA methods

|

•

|

Reconciled Legg Mason share price estimates for private companies to those of sell-side analysts

|

•

|

Analyzed company fundamentals and modeled future cash flows for senior research analysts

|

LEADERSHIP & COMMUNITY SERVICE

|

|

|

Marshal L. Salant Student Investment Team

|

Baltimore, MD

|

Co-Chair

|

Fall 2011 - present

|

•

|

Co-manage an endowment of $140k with profits providing scholarship funds

|

•

|

Apply valuation techniques in the research and investment decision making process including discounted cash flows and key ratio comparisons within sectors

|

|

|

Johns Hopkins Organization for Finance and Investment

|

President

|

August 2009 - present

|

•

|

Promote financial awareness and investment skills to student body through educational events

|

•

|

Collaborate with students, faculty, staff, and alumni to bring 4 speakers a year to campus

|

|

|

Pen Lucy Youth Partnership

|

Baltimore, MD

|

Mentor & Tutor

|

October 2009 - May 2010

|

•

|

Tutored young, underprivileged students in Mathematics and English

|

•

|

Organized activities and games to promote and emphasize teamwork

|

COMPUTER SKILLS

|

|

|

Bloomberg Terminal, SPSS, Microsoft Word, Excel, Outlook, Access, PowerPoint

|

邮箱

电话