Word格式/直接打印/内容可修改

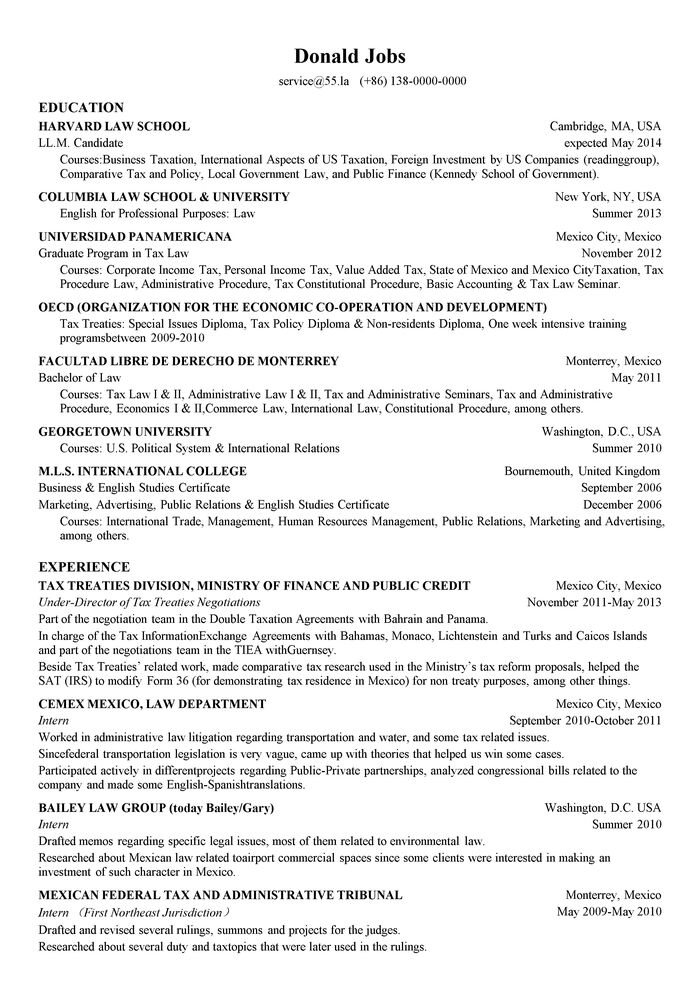

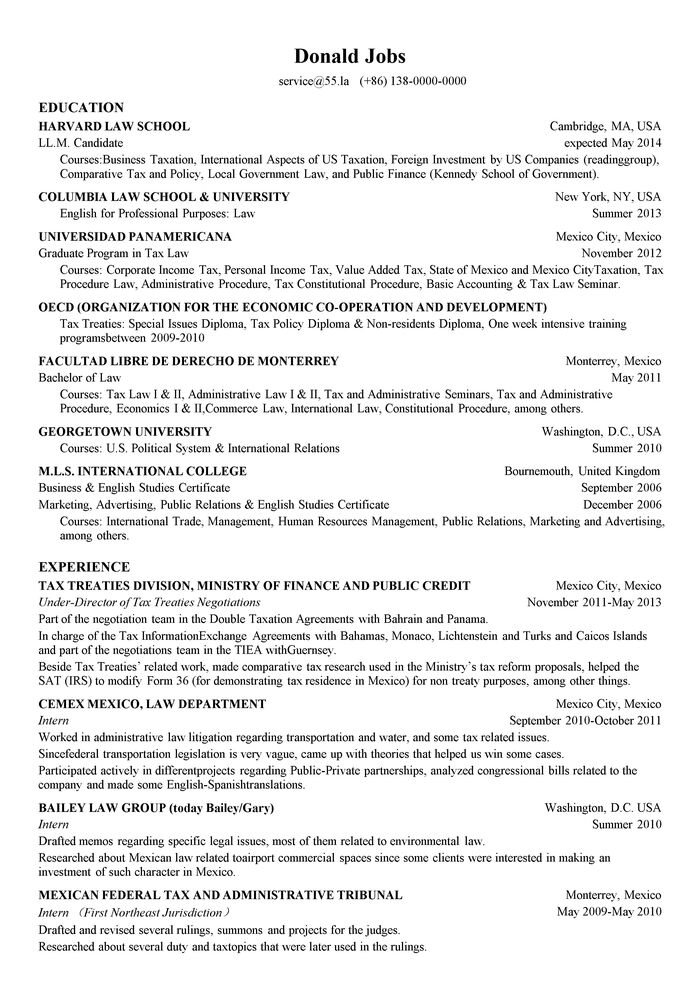

Donald Jobs

|

service@55.la

|

(+86) 138-0000-0000

|

EDUCATION

|

HARVARD LAW SCHOOL

|

Cambridge, MA, USA

|

LL.M. Candidate

|

expected May 2014

|

Courses:Business Taxation, International Aspects of US Taxation, Foreign Investment by US Companies (readinggroup), Comparative Tax and Policy, Local Government Law, and Public Finance (Kennedy School of Government).

|

|

|

COLUMBIA LAW SCHOOL & UNIVERSITY

|

New York, NY, USA

|

English for Professional Purposes: Law

|

Summer 2013

|

|

|

UNIVERSIDAD PANAMERICANA

|

Mexico City, Mexico

|

Graduate Program in Tax Law

|

November 2012

|

Courses: Corporate Income Tax, Personal Income Tax, Value Added Tax, State of Mexico and Mexico CityTaxation, Tax Procedure Law, Administrative Procedure, Tax Constitutional Procedure, Basic Accounting & Tax Law Seminar.

|

|

|

OECD (ORGANIZATION FOR THE ECONOMIC CO-OPERATION AND DEVELOPMENT)

|

Tax Treaties: Special Issues Diploma, Tax Policy Diploma & Non-residents Diploma, One week intensive training programsbetween 2009-2010

|

|

|

FACULTAD LIBRE DE DERECHO DE MONTERREY

|

Monterrey, Mexico

|

Bachelor of Law

|

May 2011

|

Courses: Tax Law I & II, Administrative Law I & II, Tax and Administrative Seminars, Tax and Administrative Procedure, Economics I & II,Commerce Law, International Law, Constitutional Procedure, among others.

|

|

|

GEORGETOWN UNIVERSITY

|

Washington, D.C., USA

|

Courses: U.S. Political System & International Relations

|

Summer 2010

|

|

|

M.L.S. INTERNATIONAL COLLEGE

|

Bournemouth, United Kingdom

|

Business & English Studies Certificate

|

September 2006

|

Marketing, Advertising, Public Relations & English Studies Certificate

|

December 2006

|

Courses: International Trade, Management, Human Resources Management, Public Relations, Marketing and Advertising, among others.

|

EXPERIENCE

|

TAX TREATIES DIVISION, MINISTRY OF FINANCE AND PUBLIC CREDIT

|

Mexico City, Mexico

|

Under-Director of Tax Treaties Negotiations

|

November 2011-May 2013

|

Part of the negotiation team in the Double Taxation Agreements with Bahrain and Panama.

|

In charge of the Tax InformationExchange Agreements with Bahamas, Monaco, Lichtenstein and Turks and Caicos Islands and part of the negotiations team in the TIEA withGuernsey.

|

Beside Tax Treaties’ related work, made comparative tax research used in the Ministry’s tax reform proposals, helped the SAT (IRS) to modify Form 36 (for demonstrating tax residence in Mexico) for non treaty purposes, among other things.

|

|

|

CEMEX MEXICO, LAW DEPARTMENT

|

Mexico City, Mexico

|

Intern

|

September 2010-October 2011

|

Worked in administrative law litigation regarding transportation and water, and some tax related issues.

|

Sincefederal transportation legislation is very vague, came up with theories that helped us win some cases.

|

Participated actively in differentprojects regarding Public-Private partnerships, analyzed congressional bills related to the company and made some English-Spanishtranslations.

|

|

|

BAILEY LAW GROUP (today Bailey/Gary)

|

Washington, D.C. USA

|

Intern

|

Summer 2010

|

Drafted memos regarding specific legal issues, most of them related to environmental law.

|

Researched about Mexican law related toairport commercial spaces since some clients were interested in making an investment of such character in Mexico.

|

|

|

MEXICAN FEDERAL TAX AND ADMINISTRATIVE TRIBUNAL

|

Monterrey, Mexico

|

Intern (First Northeast Jurisdiction)

|

May 2009-May 2010

|

Drafted and revised several rulings, summons and projects for the judges.

|

Researched about several duty and taxtopics that were later used in the rulings.

|

邮箱

电话